Smarter Mutual Fund

Investing Starts Here

Invest in mutual funds with confidence. Get guidance backed by research, risk analysis, and long-term wealth planning - all tailored to your goals.

About Us

Investments, Insurance & Cashflow Awareness

Understand how financial products work, how money flows in and out, and how insurance supports financial stability.

Financial Awareness & Goal Mapping

Structured discussions to identify, prioritize, and organize life goals such as retirement, education, and property.

Financial Wellness & Long-Term Readiness

Holistic visibility of your finances up to retirement and beyond, including tax awareness and EPF structuring.

Ongoing Review & Support

Continuous monitoring, documentation support, and periodic reviews to stay aligned with evolving goals.

Homepage Summary

Your Financial Journey, Covered End-to-End

A holistic view of planning, protection, and execution designed to keep you aligned with your goals over time.

Investments, Insurance & Cashflow Awareness

Understand how financial products work, how money flows in and out, and how insurance supports financial stability - helping you build a strong foundation before planning or investing.

Financial Awareness & Goal Mapping

Structured discussions to identify, prioritize, and organize life goals such as retirement, education, and property - bringing clarity and direction to your financial journey.

Financial Wellness & Long-Term Readiness

Holistic visibility of your finances up to retirement and beyond, including cashflow sustainability, tax awareness, and EPF account structuring for long-term preparedness.

Investment Products & Access

Execution support across mutual funds, fixed income, gold, NPS, government schemes, and international investments - delivered through simple and transparent processes.

Risk Protection & Insurance Coverage

Awareness and access to life and health insurance solutions focused on protecting income, family security, and long-term financial stability.

Ongoing Review & Support

Continuous monitoring, documentation support, and periodic reviews to help you stay aligned with evolving goals and life changes.

Investment Options

Types of Mutual Funds

Whether you want long-term growth, stable returns, or tax savings - there�s a mutual fund built for your financial goals.

Not sure which fund suits you best?

Our investment advisors can help you choose the right mutual fund based on your goals, risk appetite, and investment timeline.

DIY vs Guided Investing

Why Choose an MFD?

Choose funds yourself - or work with an expert who ensures discipline, guidance, and better decision-making.

DIY Platforms

Comparison

With an MFD

Investment Comparison

See How Different Assets Perform

Compare how your monthly investments can grow in different asset classes - from savings to mutual funds.

Savings Account

₹6,90,750

at 3% annual return

Fixed Deposit

₹8,23,494

at 6% annual return

Gold

₹9,74,828

at 9% annual return

Mutual Fund

₹13,10,457

at 14% annual return

CALCULATOR TOOLS

Want to Know How Much You Need to Invest?

Invested Amount: ₹0

Estimated Return: ₹0

Final Value: ₹0

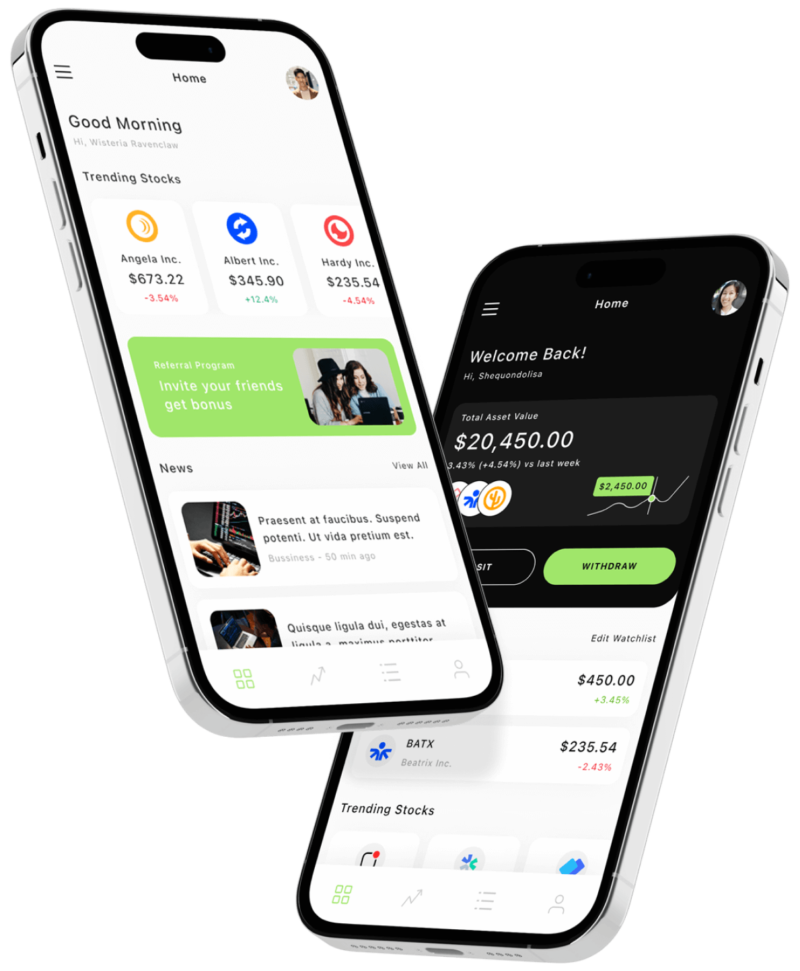

Experience Finance on the Go

Download our powerful app and unlock exclusive features, real-time insights, and special offers tailored just for you.

Secure &

Fast

4.8 Rating

on App Store

What Our Clients Say

Real experiences from investors who trusted us.

Their goal mapping sessions gave me clarity on education planning and cashflow. I appreciated the honest discussion around risk and suitability.

Neha Verma

Marketing Manager, Noida

Neha Verma

Marketing Manager, Noida

Their goal mapping sessions gave me clarity on education planning and cashflow. I appreciated the honest discussion around risk and suitability.

Rohit Gupta

Business Owner, Delhi

WealthPlan explained debt and hybrid funds in a simple way and helped me diversify beyond gold and fixed deposits. The execution support was smooth.

Shreya Iyer

HR Lead, Bengaluru

The team walked me through NPS and EPF structuring along with mutual fund options. It felt like a holistic planning conversation, not just product pitching.

Manish Singh

Chartered Accountant, Jaipur

I liked the disciplined approach and periodic review focus. Their explanations on tax awareness and goal-based investing were practical.

Ankit Sharma

IT Professional, Gurugram

WealthPlan helped me understand SIP and SWP clearly and aligned my mutual fund selection with my retirement goal. The guidance felt structured and transparent.

News

Latest News & Updates

FAQs

Answers to common questions

Answers to common questions about our services and investment options

Get in Touch

We love to hear from you. Send us a message and well respond as soon as possible.